Bill Nelson Real Estate Group Can Be Fun For Anyone

Wiki Article

The Facts About Bill Nelson Real Estate Group Revealed

Table of ContentsNot known Incorrect Statements About Bill Nelson Real Estate Group Bill Nelson Real Estate Group Can Be Fun For AnyoneOur Bill Nelson Real Estate Group IdeasThe Definitive Guide for Bill Nelson Real Estate Group7 Simple Techniques For Bill Nelson Real Estate GroupThe Basic Principles Of Bill Nelson Real Estate Group

You're not curious about month-to-month rents when flipping a residence. Rather, you need to purchase a residence for the most affordable possible rate if you intend to make a great profit when selling. Once again, research study is essential (bill nelson real estate group). You wish to discover a house in an attractive area, one that brings in a lot of customers.

Diversifying your investment portfolio is vital. If you place all your eggs in one basket, you can suffer an overall loss in the blink of an eye. Yet when you invest some funds in the stock exchange, various other funds in bonds or ETFs, as well as some in actual estate, you increase your opportunities of higher earnings and less losses.

What Does Bill Nelson Real Estate Group Mean?

Neither is accurate, and to assure you, here are eight terrific reasons realty is a great financial investment. The Leading Reasons Property Is a Good Investment If you're thinking of spending in genuine estate, you're regarding to begin on among the very best financial investment trips of your life time.There aren't a lot of other financial investments that permit you to purchase possessions worth a lot more than you have to invest. As an example, if you have $10,000 to buy the securities market, you can typically acquire just $10,000 well worth of supply. The exception is if you buy margin (borrow), but you have to be an accredited capitalist with a high total assets to make that take place.

As an example, allow's state you discovered a home for $100,000; if you place down $10,000, opportunities are you could find a financing to finance the rest as long as you have great debt as well as steady income. With that said, it implies you spend just 10% of the possession's worth and also own it.

7 Simple Techniques For Bill Nelson Real Estate Group

Unlike stocks or bonds, you can compel the genuine estate to value. On standard, actual estate values 3% 5% a year without you doing anything except keeping the home.You will not get a dollar-for-dollar return on your investments, but some remodellings can pay you back as much as 80% 90% of the cash spent. The renovations do not have to be major either. Naturally, including a space or finishing the cellar will add even more value than easy cosmetic remodellings, yet even minor bathroom and kitchen renovations can significantly affect a residence's well worth.

While it's an investment, when you have a home as well as lease it out, you run a service you are the landlord. As the organization owner, you can often cross out the complying with costs: The home mortgage interest paid on the financing Origination factors paid on the lending Upkeep expenses Depreciation (expanded over 27.

Top Guidelines Of Bill Nelson Real Estate Group

When you invest in supplies or bonds, you can just cross out any kind of funding losses if you market the possession for less than you spent for it. bill nelson real estate group. If you purchase and also hold realty, you can gain regular monthly cash flow renting it out, as well as this enhances the benefit from owning actual estate since you aren't depending only on the recognition yet the regular monthly rental income.Roofstock Industry is an excellent resource. They not only checklist available investment helpful hints homes available for sale, however several of them have tenants with leases in position currently. When you acquire the residence, you immediately come to be a property owner. Roofstock additionally uses lots of due persistance, researching you, so all you have to do is buy the residential property you think is best.

Without risk, there can not be a benefit. There's very little to really feel safe and secure about when you buy the market. Yet, as 2020 revealed, it can change in the blink of an eye. One minute you have a significant financial investment, as well as the next, you've lost everything. When you spend in property long-term, you know you have an appreciating property.

Excitement About Bill Nelson Real Estate Group

Many individuals spend in actual estate to supplement their retirement earnings. Whether you possess the residential or commercial property while you're retired, making the month-to-month rental cash flow to supplement your earnings, or you sell a building you have actually owned for several years when you're in retirement as well as earn a profit, you'll raise your retired life revenue.

If getting property as well as leasing it out is too stressful for you, there are several various other means to buy property, consisting of: Buy an undervalued property, fix it up and flip go to this site it (solution as well as flip) Be a dealer working as the middle male in between determined vendors as well as a network of purchasers.

Buy a Genuine Estate Financial Investment Trust fund If you wish to leave a heritage behind yet don't assume going cash money is a great concept, passing actual estate down can be also better. Not only will you offer your successors an income-producing possession, yet it's additionally an visit here appreciating asset. So they can either keep the building as well as allow the heritage proceed or sell it and earn revenues.

Indicators on Bill Nelson Real Estate Group You Should Know

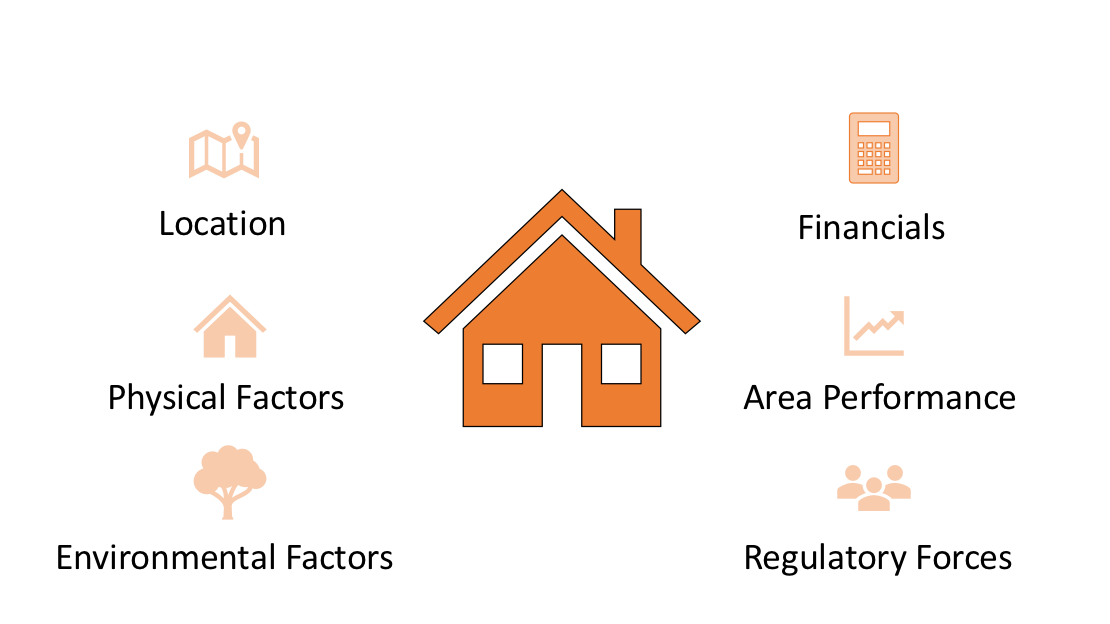

While there's not a one-size-fits-all solution, there specify attributes to seek when you buy actual estate, including: Search for an area that's attractive for tenants or with fast appreciating homes. Ensure the area has all the facilities as well as comforts most home owners desire Look at the location's crime rate, school ratings, and tax history.

Report this wiki page